Kaplan Thought Leadership

Trends and Insights

Reimagining the paths through education and career

Our Latest Insights and Industry Updates

Industry Updates

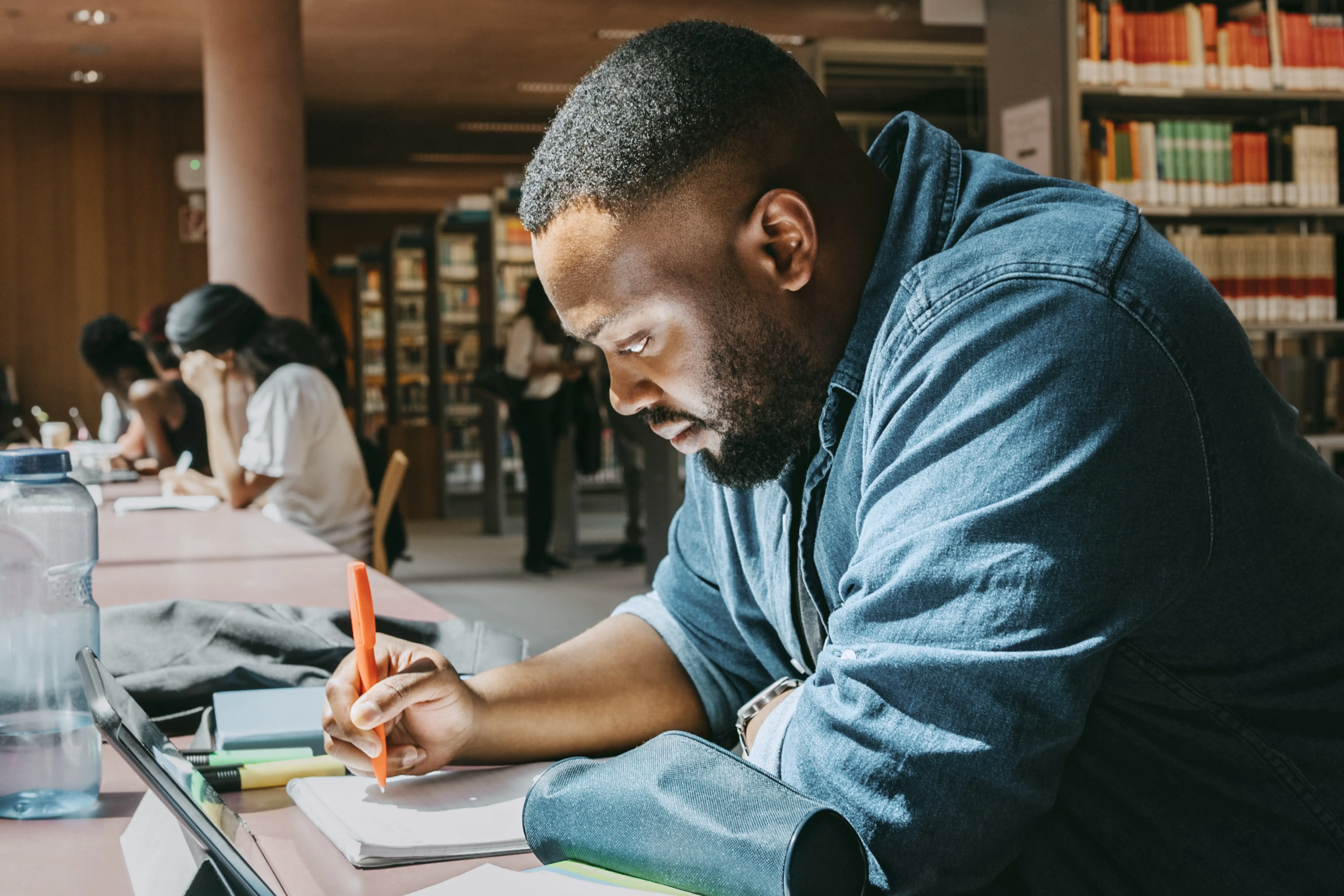

Business & Corporate Learning

View All Articles

Career Insights

Career advancement often requires a map, and a guide - Kaplan Trends & Insights

Industry Updates

Three Ways Corporate Education Can Support Diversity and Inclusivity Goals

Universities & Higher Education

View all Articles

Thought Leadership

Expanding Access for Student Success: A Focus on Career Outcomes and Equity

Thought Leadership

The University of Texas at Austin’s Holistic Approach to Enhancing Academic Equity

Career Insights

View All Articles

Thought Leadership

Thought Leadership

Looking Back to Look Ahead: The Best Way to Think About AI for Education

Bold Leaders in Learning

Explore More About Kaplan

Not finding what you’re looking for?

Search for products, pages, or articles

We're Here to Help. Let Us Guide You.

At Kaplan, we help build futures. Specifically yours. Ready to get started?

Try Our Step-by-step Guide